What are the best practices for improving disclosure about E&E activites under IFRS6 and the roles does industry alignment play in the implementation of IFRS 6 And how company determines which E&E expenditures to capitalise

The implementation of IFRS 6, “Exploration for and Evaluation of Mineral Resources,” has significant implications for how mining companies disclose their exploration and evaluation (E&E) activities. To improve transparency and compliance with the standard, companies can adopt best practices in their reporting. Additionally, industry alignment plays a crucial role in the effective implementation of IFRS 6, particularly in determining which E&E expenditures to capitalize

Best Practices for Improving Disclosure About E&E Activities

- Comprehensive Disclosure of Accounting Policies:

Companies should clearly disclose their accounting policies regarding E&E expenditures, including the method chosen (e.g., successful efforts or full cost) and the rationale behind this choice. This transparency helps stakeholders understand how E&E costs are treated in financial statements.

Example: A mining company could provide a detailed note in its financial statements explaining that it uses the successful efforts method, capitalizing only costs associated with successful exploration activities and expensing others. This note could also describe the criteria used to determine success. - Detailed Breakdown of E&E Expenditures:

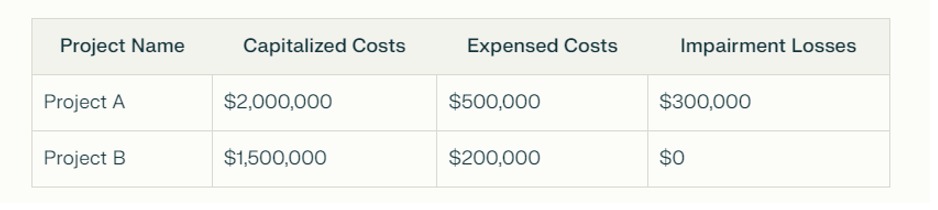

Companies should provide a detailed breakdown of E&E expenditures by project or area of interest. This includes capitalized costs, expensed costs, and any impairment losses recognized during the reporting period.

Example: A company disclosing E&E expenditures might present a table showing the following:

- This level of detail allows investors to assess the financial implications of each project and the company’s overall exploration strategy.

- Reconciliation of E&E Assets:

Providing a reconciliation of the opening and closing balances of E&E assets can enhance transparency. This reconciliation should include capitalized costs, expensed amounts, and any write-offs

Example: A mining company could present a reconciliation as follows:

This reconciliation provides stakeholders with a clear understanding of how E&E assets have changed over the reporting period.

3.Disclosure of Risks and Uncertainties:

Companies should disclose the risks and uncertainties associated with their E&E activities. This includes potential changes in commodity prices, regulatory risks, and geological uncertainties.

Example: A company might include a section in its annual report discussing the potential impact of fluctuating gold prices on the viability of its exploration projects, along with strategies to mitigate these risks.

4.Regular Updates on E&E Projects:

Providing regular updates on the progress of E&E projects, including milestones achieved and future plans, can enhance stakeholder engagement and transparency.

Example: A mining company could issue quarterly updates detailing the status of ongoing exploration projects, including drilling results and any changes in the estimated timeline for development.

The Role of Industry Alignment in Implementing IFRS 6

Industry alignment plays a critical role in the implementation of IFRS 6, as companies often face similar challenges and opportunities in their E&E activities. By aligning their practices with industry standards, companies can enhance comparability and consistency in financial reporting.

- Adopting Common Accounting Practices:

When companies within the same industry adopt common accounting practices for E&E expenditures, it improves the consistency of financial reporting. This alignment can facilitate better comparisons among companies, making it easier for investors to evaluate performance.

Example: If a majority of mining companies adopt the successful efforts method, new entrants to the market may also choose this method to align with industry norms, enhancing comparability.

- Collaborative Industry Initiatives:

Industry associations can play a role in developing best practices and guidelines for financial reporting under IFRS 6. By collaborating on common challenges, companies can share insights and improve their reporting practices.

Example: An industry group may publish a guideline document that outlines best practices for disclosing E&E expenditures, helping member companies enhance their compliance with IFRS 6.

- Feedback to Standard-Setters:

Industry alignment can facilitate collective feedback to standard-setters like the IASB regarding the effectiveness of IFRS 6. By providing insights into the challenges faced in applying the standard, companies can contribute to potential improvements in the framework.

Example: Mining companies may collectively advocate for clearer guidance on impairment testing or more specific disclosure requirements, which could lead to amendments in IFRS 6 that benefit the industry as a whole.

Determining Which E&E Expenditures to Capitalize

Companies must carefully evaluate which E&E expenditures to capitalize based on IFRS 6 requirements. The following criteria can guide this determination:

- Legal Rights to Explore:

Costs incurred after obtaining legal rights to explore a specific area can be capitalized. This includes costs related to geological studies, drilling, and other exploration activities.

Example: If a mining company spends $1 million on geological surveys and drilling after securing exploration rights, these costs can be capitalized as E&E assets.

- Technical and Commercial Viability:

Companies must demonstrate that the exploration activities are likely to lead to commercially viable discoveries. This assessment often requires management judgment and may involve feasibility studies.

Example: A company may capitalize costs incurred during exploration if it receives a favorable feasibility report indicating that the project has the potential for commercial success.

- Successful Efforts vs. Full Cost Method:

Depending on the accounting policy adopted (successful efforts or full cost), the criteria for capitalization may differ. Under the successful efforts method, only costs associated with successful exploration activities are capitalized, while the full cost method allows for the capitalization of all exploration costs.

Example: If a company using the successful efforts method incurs $2 million in exploration costs but only $1 million leads to a viable discovery, it would capitalize only the $1 million.

- Documentation and Tracking:

Maintaining accurate records of E&E expenditures is crucial for determining which costs to capitalize. Companies should implement robust tracking systems to ensure compliance with IFRS

Example: A mining company could use project management software to track all costs associated with each exploration project, ensuring that capitalized costs are accurately reflected in financial statements.

Criteria do companies use to decide which E&E expenditures to capitalize

When companies engage in exploration and evaluation (E&E) activities under IFRS 6, they must carefully assess which expenditures to capitalize as assets. This decision-making process is guided by specific criteria outlined in the standard, as well as best practices that promote transparency and consistency in financial reporting. Below are the key criteria companies use to determine which E&E expenditures to capitalize, along with insights into the importance of industry alignment and best practices for disclosure.

Criteria for Capitalizing E&E Expenditures

- Legal Rights to Explore:

- Companies can capitalize costs incurred after obtaining legal rights to explore a specific area. This includes costs related to acquiring exploration licenses and permits.

- Example: If a mining company incurs $500,000 in costs to secure exploration rights for a mineral deposit, these costs can be capitalized as exploration assets.

- Companies can capitalize costs incurred after obtaining legal rights to explore a specific area. This includes costs related to acquiring exploration licenses and permits.

- Technical Feasibility:

- Expenditures can be capitalized if the company demonstrates that the exploration activities are technically feasible. This often involves conducting geological studies and obtaining feasibility reports.

- Example: A company spends $1 million on exploratory drilling and receives a favorable feasibility report indicating the potential for commercially viable mineral extraction. The company can capitalize these drilling costs.

- Expenditures can be capitalized if the company demonstrates that the exploration activities are technically feasible. This often involves conducting geological studies and obtaining feasibility reports.

- Commercial Viability:

- Companies must assess whether the exploration activities are likely to lead to commercially viable discoveries. This assessment may require management judgment based on market conditions and resource estimates.

- Example: If a company discovers a mineral resource but the current market price makes extraction unprofitable, it may decide not to capitalize the exploration costs associated with that project.

- Companies must assess whether the exploration activities are likely to lead to commercially viable discoveries. This assessment may require management judgment based on market conditions and resource estimates.

- Successful Efforts vs. Full Cost Method:

- Depending on the accounting policy adopted (successful efforts or full cost), the criteria for capitalization may differ:

- Successful Efforts Method: Only costs associated with successful exploration activities are capitalized.

- Full Cost Method: All exploration costs are capitalized, regardless of the outcome.

- Successful Efforts Method: Only costs associated with successful exploration activities are capitalized.

- Example: Under the successful efforts method, if a company spends $3 million on exploration but only $2 million leads to a viable discovery, it would capitalize only the $2 million.

- Depending on the accounting policy adopted (successful efforts or full cost), the criteria for capitalization may differ:

- Directly Attributable Costs:

- Only costs that can be directly attributed to exploration and evaluation activities should be capitalized. General overhead costs that do not relate directly to specific exploration projects cannot be capitalized.

- Example: If a company incurs $200,000 in administrative expenses unrelated to a specific exploration project, these costs must be expensed rather than capitalized.

- Only costs that can be directly attributed to exploration and evaluation activities should be capitalized. General overhead costs that do not relate directly to specific exploration projects cannot be capitalized.

- Documentation and Tracking:

- Companies must maintain accurate records of E&E expenditures to support their capitalization decisions. This includes tracking costs associated with each exploration project and ensuring compliance with IFRS 6.

- Example: A mining company implements a project management system to track all costs related to its exploration activities, ensuring that only eligible costs are capitalized.

- Companies must maintain accurate records of E&E expenditures to support their capitalization decisions. This includes tracking costs associated with each exploration project and ensuring compliance with IFRS 6.

The Role of Industry Alignment in Implementation

Industry alignment plays a crucial role in the effective implementation of IFRS 6, as companies within the same sector often face similar challenges and opportunities in their E&E activities. Here are some ways industry alignment can enhance the application of IFRS 6:

- Common Accounting Practices:

- When companies adopt similar accounting practices for E&E expenditures, it improves the consistency of financial reporting. This alignment facilitates better comparisons among companies, making it easier for investors to evaluate performance.

- Example: If most mining companies adopt the successful efforts method, new entrants may also choose this method to align with industry norms, enhancing comparability.

- Collaborative Industry Initiatives:

- Industry associations can develop best practices and guidelines for financial reporting under IFRS 6. By collaborating on common challenges, companies can share insights and improve their reporting practices.

- Example: An industry group may publish a guideline document that outlines best practices for disclosing E&E expenditures, helping member companies enhance their compliance with IFRS 6.

- Feedback to Standard-Setters:

- Industry alignment can facilitate collective feedback to standard-setters like the IASB regarding the effectiveness of IFRS 6. By providing insights into the challenges faced in applying the standard, companies can contribute to potential improvements in the framework.

- Example: Mining companies may collectively advocate for clearer guidance on impairment testing or more specific disclosure requirements, which could lead to amendments in IFRS 6 that benefit the industry as a whole.

Best Practices for Disclosure

- Clear Disclosure of Accounting Policies:

- Companies should clearly disclose their accounting policies regarding E&E expenditures, including the method chosen and the rationale behind this choice.

- Detailed Breakdown of E&E Expenditures:

- Providing a detailed breakdown of E&E expenditures by project or area of interest allows stakeholders to assess the financial implications of each project.

- Reconciliation of E&E Assets:

- A reconciliation of the opening and closing balances of E&E assets can enhance transparency and provide stakeholders with a clear understanding of how E&E assets have changed over the reporting period.

- Disclosure of Risks and Uncertainties:

- Companies should disclose the risks and uncertainties associated with their E&E activities, including potential changes in commodity prices and geological uncertainties.

- Regular Updates on E&E Projects:

- Providing regular updates on the progress of E&E projects, including milestones achieved and future plans, can enhance stakeholder engagement and transparency.

Conclusion

Improving disclosure about exploration and evaluation activities under IFRS 6 requires companies to adopt best practices in financial reporting, including comprehensive disclosures, detailed breakdowns of expenditures, and regular updates on project progress. Industry alignment plays a crucial role in enhancing the implementation of IFRS 6, enabling companies to adopt common practices and provide consistent information to stakeholders. By carefully evaluating which E&E expenditures to capitalize based on established criteria, companies can ensure compliance with IFRS 6 while providing transparent and meaningful financial statements.