Impact of IFRS 2 on Financial Statements & valuation methods

IFRS 2, Share-based Payment, significantly influences the financial statements of entities by mandating the recognition and measurement of share-based payment transactions. This standard requires companies to account for transactions involving equity instruments, such as share options and share appreciation rights, in a manner that reflects their economic reality. The implications of IFRS 2 extend beyond mere compliance; they affect key financial metrics, influence management decisions, and shape stakeholder perceptions.

Recognition and Measurement

Under IFRS 2, entities must recognize an expense for share-based payments at fair value. This recognition occurs when the goods or services are received, which can complicate accounting practices. For instance, if a company grants share options to employees that vest over time, the expense must be recognized over the vesting period based on the estimated number of options expected to vest. This approach ensures that the financial statements reflect the cost of compensation in alignment with the services rendered.The impact on the income statement is profound. For example, if a company issues share options with a fair value of $1 million to its employees, this amount must be expensed in the income statement over the vesting period. Consequently, this reduces reported profits during that time, affecting profitability ratios and potentially influencing investor perceptions.

Effect on Financial Position

The balance sheet also reflects significant changes due to IFRS 2. When equity instruments are issued as part of a share-based payment transaction, there is an increase in equity corresponding to the fair value of the instruments granted. For instance, if shares are issued to acquire inventory valued at $500,000, both inventory and equity will increase by this amount. This dual impact can alter key indicators such as return on equity (ROE) and leverage ratios.Moreover, IFRS 2 requires companies to assess whether share-based payments should be classified as cash-settled or equity-settled. Cash-settled transactions create liabilities that must be measured at fair value until settled, adding complexity to financial reporting and potentially increasing volatility in earnings due to fluctuations in share prices.

Disclosure Requirements

IFRS 2 imposes extensive disclosure requirements aimed at enhancing transparency regarding share-based payment transactions. Companies must provide information that allows users of financial statements to understand:

- The nature and extent of share-based payment arrangements.

- How the fair value of goods or services received was determined.

- The impact of these expenses on profit or loss for the period.

These disclosures are crucial for investors and analysts who seek to evaluate the potential dilution of shares and understand how compensation strategies align with company performance.

Strategic Implications

The implementation of IFRS 2 can influence corporate strategy, particularly regarding employee compensation plans. Companies may need to reassess their remuneration structures to manage the financial implications effectively. For instance, organizations might opt for cash-based incentives instead of equity-based ones to mitigate the impact on reported earnings and avoid potential dilution concerns among shareholders.Furthermore, management must develop robust systems for estimating fair values and tracking performance conditions associated with share options. This requirement often necessitates specialized valuation expertise and comprehensive data collection processes, which can incur additional costs but ultimately lead to more accurate financial reporting.

Valuation Techniques for Share-Based Payments

Valuing share-based payments under IFRS 2 presents significant challenges, particularly when market prices are not available. The standard requires entities to estimate the fair value of equity instruments granted in share-based payment transactions, which can vary widely based on the chosen valuation technique. This article explores the primary valuation methods used to comply with IFRS 2, emphasizing their application and the considerations involved.

Fair Value Measurement Principles

IFRS 2 mandates that the fair value of equity instruments should be determined based on market prices when available. However, many share options and equity instruments are not traded on active markets, necessitating the use of various valuation techniques. The objective is to estimate what the price of these instruments would have been in an arm’s length transaction between knowledgeable, willing parties at the measurement date.

Common Valuation Techniques

- Black-Scholes Model

- The Black-Scholes model is one of the most widely used methods for valuing share options. It calculates the theoretical price of options based on several factors, including:

- Current stock price

- Exercise price of the option

- Time to expiration

- Risk-free interest rate

- Expected volatility of the stock price

- The Black-Scholes model is one of the most widely used methods for valuing share options. It calculates the theoretical price of options based on several factors, including:

The model assumes that stock prices follow a log normal distribution and provides a closed-form solution for European-style options, which can only be exercised at expiration.

Example:

A U.S.-based technology company, Microsoft Corporation, grants its employees stock options that can be exercised in five years. The company uses the Black-Scholes model to determine the fair value of these options at the grant date. Assuming the following parameters:

Using these inputs in the Black-Scholes formula, Microsoft calculates a fair value of approximately $60 per option. If Microsoft grants 1,000 options to an employee, it would recognize an expense of $60,000 over the vesting period in its financial statements.

2. Binomial Model

- The Binomial model offers a more flexible approach compared to Black-Scholes, allowing for varying assumptions over the life of the option. This model constructs a binomial tree to represent possible future stock prices at different points in time, enabling:

- Valuation of American-style options that can be exercised at any time before expiration.

- Incorporation of changing volatility and interest rates throughout the option’s life.

- This method is particularly useful for complex options with multiple exercise features or performance conditions.

Example:

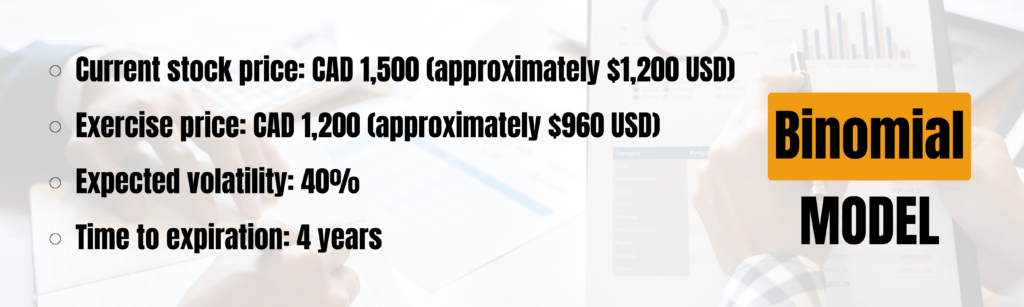

A Canadian company, Shopify Inc., issues share options to its executives that vest based on performance metrics. The company applies the Binomial model to value these options. Key parameters include:

Shopify constructs a binomial tree that simulates potential stock price movements over four years. After running the calculations through multiple iterations, Shopify determines a fair value of approximately $300 per option (around $240 USD). If Shopify grants 500 options to an executive, it would recognize an expense of $120,000 over the vesting period.

3. Monte Carlo Simulation

- Monte Carlo simulation is a sophisticated technique used for valuing share-based payments with complex features, such as market performance conditions. This method involves:

- Generating a large number of random price paths for the underlying stock based on assumed volatility and other factors.

- Calculating the payoff for each path and averaging these payoffs to determine the option’s fair value.

- This approach is beneficial when dealing with contingent claims that depend on multiple uncertain future variables.

Example:

A U.K.-based pharmaceutical company, AstraZeneca PLC, offers performance share awards contingent on achieving specific total shareholder return (TSR) targets relative to industry peers. AstraZeneca employs Monte Carlo simulation to estimate the fair value of these awards. The process includes: - Setting parameters such as current stock price: £75 (approximately $95 USD),

expected volatility (25%),

and risk-free rate (1%). - Running 100,000 simulations to model potential future TSR outcomes.

After analyzing the results of these simulations, AstraZeneca finds that the average payout per award is approximately $30 USD. If AstraZeneca grants 1,000 awards to employees based on these conditions, it would record an expense of $30,000 over the vesting period in its financial statements.

Intrinsic Value Method

In cases where fair value cannot be reliably measured using other methods, IFRS 2 allows for the use of intrinsic value. Intrinsic value is defined as the difference between the fair value of shares and their exercise price at a given point in time. However, this method is typically reserved for rare cases where other valuation techniques are impractical. It requires ongoing remeasurement until final settlement, which can add complexity to financial reporting.

Considerations in Valuation

When applying these valuation techniques, several factors must be carefully considered:

- Volatility Estimates: The expected volatility of the underlying stock significantly influences option pricing models. Historical volatility or implied volatility from market prices can be used, but assumptions must reflect realistic expectations about future price movements.

- Expected Life: Estimating the expected life of an option is crucial as it affects both time value and potential exercise behavior. Companies often rely on historical data or industry benchmarks to make these estimates.

- Market Conditions: For options with market-based performance conditions (e.g., achieving a specific stock price), these conditions must be factored into the initial valuation but are not adjusted subsequently unless they affect vesting outcomes

The valuation of share-based payments under IFRS 2 necessitates careful consideration of various techniques depending on the specific circumstances surrounding each arrangement. The Black-Scholes model is suitable for simpler scenarios involving European-style options; the Binomial model offers flexibility for American-style options and performance conditions; and Monte Carlo simulation provides a robust approach for complex arrangements with market conditions. Each method’s application ensures compliance with IFRS 2 while enhancing transparency in financial reporting.

Conclusion

In summary, IFRS 2 has a profound impact on financial statements by requiring recognition of share-based payments as expenses over their vesting periods while simultaneously increasing equity when shares are issued. The standard’s stringent disclosure requirements enhance transparency but also demand careful management consideration regarding compensation strategies. As companies navigate these complexities, understanding the implications of IFRS 2 becomes essential for accurate financial reporting and effective stakeholder communication.