The Impact of Depreciation Methods on Financial Statements Under IAS 16

The recognition of property, plant, and equipment (PPE) is a fundamental aspect of IAS 16, which prescribes the accounting treatment for these tangible assets. Proper recognition is essential for providing accurate financial information that reflects an entity’s investment in its operational capabilities. This article discusses the key recognition criteria outlined in IAS 16, focusing on the conditions that must be met for an asset to qualify as property, plant, and equipment.

Recognition Criteria

According to IAS 16, an item of property, plant, and equipment should be recognized as an asset if it meets two primary criteria:

- Probable Future Economic Benefits: The first criterion requires that it is probable that future economic benefits associated with the asset will flow to the entity. This means that the asset must have the potential to contribute positively to the entity’s cash flows, either through revenue generation or cost savings. The assessment of this criterion often involves evaluating the asset’s expected utility in the production or supply of goods and services, or its use in administrative functions.

- Reliable Measurement of Cost: The second criterion stipulates that the cost of the item can be measured reliably. This includes all costs directly attributable to bringing the asset to its intended location and condition for use. Costs may encompass purchase prices, import duties, non-refundable taxes, and any other expenses necessary to make the asset operational. If the costs cannot be reliably measured, recognition as an asset is not permitted.

Exclusions from Recognition

IAS 16 also outlines specific exclusions regarding what constitutes property, plant, and equipment:

- Day-to-Day Servicing Costs: Costs incurred for day-to-day servicing or maintenance of an asset are not included in its carrying amount but are instead expensed as incurred. These costs do not enhance the asset’s future economic benefits; rather, they merely maintain its current condition.

- Assets Classified as Held for Sale: Items classified as held for sale under IFRS 5 are excluded from recognition under IAS 16. Such assets are accounted for differently due to their intended sale rather than continued use.

- Biological Assets: Biological assets related to agricultural activity are also excluded from IAS 16 unless they qualify as bearer plants.

Measurement After Recognition

Once an item of property, plant, and equipment is recognized, it must be measured at its cost initially. Subsequent measurement can follow either a cost model or a revaluation model:

- Cost Model: Under this model, the carrying amount of an asset is its cost less any accumulated depreciation and impairment losses.

- Revaluation Model: This model allows entities to measure assets at fair value at the date of revaluation less any subsequent accumulated depreciation and impairment losses. However, revaluations must be conducted with sufficient regularity to ensure that carrying amounts do not differ materially from fair value.

The Impact of Depreciation Methods on Financial Statements Under IAS 16

The accounting treatment of property, plant, and equipment (PPE) under IAS 16 involves various depreciation methods that significantly influence financial statements. The choice of depreciation method affects the allocation of an asset’s cost over its useful life, impacting both the income statement and balance sheet. This article explores the various depreciation methods outlined in IAS 16 and their implications for financial reporting.

Common Depreciation Methods

IAS 16 allows several methods for calculating depreciation, each with distinct impacts on financial statements:

- Straight-Line Method

- This method allocates an equal amount of depreciation expense each period over the asset’s useful life. It is simple to apply and provides predictable expense recognition. The straight-line method is often preferred for assets that provide consistent utility over time.

- Impact: By spreading the depreciation evenly, this method stabilizes profit margins, making it easier for stakeholders to forecast future earnings. However, it may not reflect the actual usage pattern of some assets, potentially leading to a mismatch between expense recognition and economic benefits.

- Example:

A company purchases machinery for $100,000 with an estimated useful life of 10 years and a residual value of $10,000. Under the straight-line method, the annual depreciation expense is calculated as follows:

- This method allocates an equal amount of depreciation expense each period over the asset’s useful life. It is simple to apply and provides predictable expense recognition. The straight-line method is often preferred for assets that provide consistent utility over time.

Thus, the company will record a depreciation expense of $9,000 each year for 10 years.

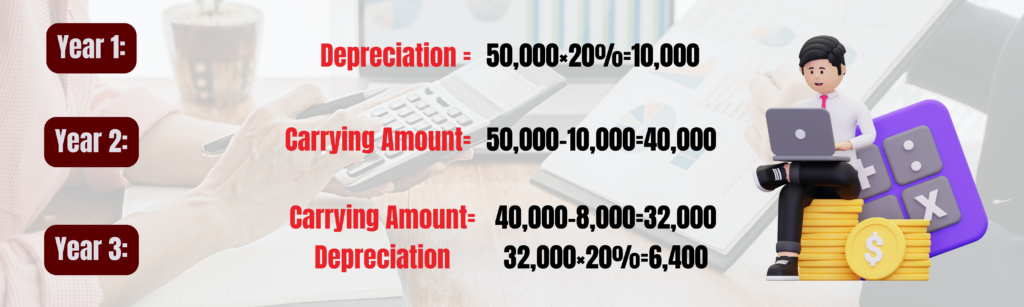

- Diminishing Balance Method

- Also known as the declining balance method, this approach calculates depreciation based on a fixed percentage of the asset’s carrying amount at the beginning of each period. As a result, the depreciation expense decreases over time.

- Impact: This method can lead to higher initial expenses, reducing profits in early years but allowing for lower expenses later on. This pattern may more accurately reflect the consumption of an asset’s economic benefits, particularly for those that lose value quickly due to obsolescence. However, it can complicate financial forecasting and analysis due to fluctuating expense levels.

- Example:

A company acquires equipment for $50,000 with a useful life of 5 years and chooses a depreciation rate of 20% per year using the diminishing balance method. The depreciation expense for each year would be calculated as follows:

- Also known as the declining balance method, this approach calculates depreciation based on a fixed percentage of the asset’s carrying amount at the beginning of each period. As a result, the depreciation expense decreases over time.

This pattern continues until the asset is fully depreciated or reaches its residual value.

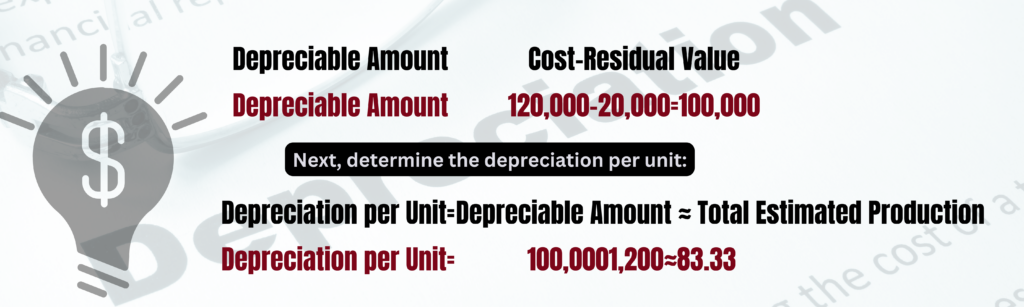

3. Units of Production Method

- This method bases depreciation on actual usage or output rather than time. The depreciation expense is calculated based on the number of units produced or hours used during a specific period.

- Impact: The units of production method aligns depreciation closely with actual asset utilization, providing a more accurate reflection of an asset’s economic contribution. However, it introduces variability in expense recognition that can complicate financial analysis and projections.

- Example:

A manufacturing company purchases a machine for $120,000 that is expected to produce a total of 1,200 units over its useful life. The estimated residual value is $20,000. If the machine produces 300 units in the first year and then produces 400 units in the second year, the annual depreciation expense would be calculated as follows:First, calculate the depreciable amount:

Year 1 Depreciation (300 units produced):

300×83.33≈25,000300×83.33≈25,000

Year 2 Depreciation (400 units produced):

400×83.33≈33,333400×83.33≈33,333

These examples illustrate how different depreciation methods impact financial statements under IAS 16 by affecting annual expenses and asset valuations differently.

Implications for Financial Statements

The choice of depreciation method has far-reaching implications for an entity’s financial statements:

- Income Statement: The selected method directly affects the reported profit or loss for each accounting period. For instance, using the straight-line method results in predictable expenses, while the diminishing balance method can lead to significant fluctuations in profits due to varying depreciation charges.

- Balance Sheet: Depreciation reduces the carrying amount of assets on the balance sheet. The choice of method affects how quickly assets are depreciated and can influence key financial ratios such as return on assets (ROA) and asset turnover ratios. A higher carrying value from slower depreciation methods may result in better ratios initially but could misrepresent true asset utilization over time.

- Cash Flow Statement: Although depreciation is a non-cash expense, it impacts cash flow indirectly by affecting taxable income. Different methods can lead to variations in tax liabilities due to differing profit levels reported under each method.

Considerations for Choosing a Depreciation Method

When selecting a depreciation method, entities should consider several factors:

- Nature of the Asset: Assets that experience rapid technological changes may benefit from accelerated depreciation methods like diminishing balance to reflect their declining utility more accurately.

- Usage Patterns: If an asset’s utility varies significantly with usage (e.g., machinery), the units of production method may provide a more accurate expense allocation.

- Financial Reporting Objectives: Companies may choose methods that align with their financial reporting strategies or stakeholder expectations, balancing between presenting stable earnings and reflecting economic realities.

Conclusion

The choice of depreciation method under IAS 16 has significant implications for financial statements, affecting income recognition, asset valuation, and overall financial performance analysis. Understanding these impacts is crucial for stakeholders who rely on accurate financial reporting to make informed decisions. As companies navigate these complexities, they must select a method that best reflects their operational realities while ensuring compliance with international accounting standards.