A key insights on post employment benefits under IAS 19 and how it is diffrent from contribution plan is their any relationship or categorisation?

IAS 19, “Employee Benefits,” provides a comprehensive framework for accounting for various employee benefits, including post-employment benefits. This standard is crucial for ensuring that companies recognize and disclose their obligations related to employee benefits accurately. A key insight into IAS 19 is its focus on the timing of recognizing expenses and liabilities, particularly in relation to post-employment benefits, which can significantly impact a company’s financial statements.

Key Insights on Post-Employment Benefits Under IAS 19

- Recognition of Liabilities and Expenses:

IAS 19 requires entities to recognize a liability when an employee has provided service in exchange for benefits to be paid in the future. This aligns with the matching principle, where expenses are recognized in the period when the related revenue is earned.

- Practical Example: If a company promises to pay a pension to an employee upon retirement, it must recognize the liability for this pension benefit as the employee provides service during their employment. For instance, if an employee has worked for 20 years and is entitled to a pension of $30,000 per year upon retirement, the company must calculate the present value of this obligation and recognize it in its financial statements.

- Practical Example: If a company promises to pay a pension to an employee upon retirement, it must recognize the liability for this pension benefit as the employee provides service during their employment. For instance, if an employee has worked for 20 years and is entitled to a pension of $30,000 per year upon retirement, the company must calculate the present value of this obligation and recognize it in its financial statements.

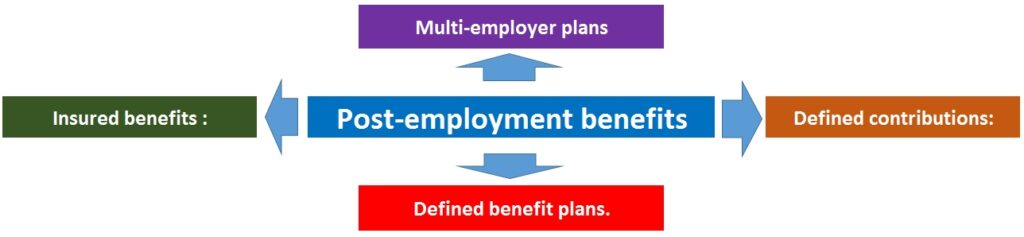

- Types of Post-Employment Benefits:

IAS 19 categorizes post-employment benefits into two main types: defined contribution plans and defined benefit plans. This distinction is crucial as it determines how the benefits are accounted for.

- Defined Contribution Plans: In these plans, the employer’s obligation is limited to the contributions it makes to the plan. The expense is recognized when the contributions are due. For example, if a company contributes 10% of an employee’s salary to a retirement fund, it recognizes this expense as incurred.

- Defined Benefit Plans: These plans require more complex accounting. The employer must estimate the future benefits to be paid and discount them to present value. This involves actuarial assumptions about employee longevity, salary increases, and interest rates.

- Actuarial Valuation:

For defined benefit plans, IAS 19 mandates the use of actuarial valuations to determine the present value of the defined benefit obligation. This valuation must consider various factors, including demographic assumptions (e.g., employee turnover, mortality rates) and financial assumptions (e.g., discount rates, salary growth).

- Example: A company with a defined benefit pension plan might engage an actuary to calculate the present value of future pension payments. If the actuary determines that the total obligation is $5 million, the company must recognize this liability on its balance sheet.

- Example: A company with a defined benefit pension plan might engage an actuary to calculate the present value of future pension payments. If the actuary determines that the total obligation is $5 million, the company must recognize this liability on its balance sheet.

- Remeasurement of Plan Assets and Liabilities:

IAS 19 requires entities to recognize actuarial gains and losses in other comprehensive income (OCI) rather than profit or loss. This treatment helps to smooth out the effects of volatility in pension costs over time.

- Practical Example: If the market value of the plan assets increases significantly due to favorable investment returns, this gain would be recognized in OCI, affecting the equity section of the balance sheet but not the profit or loss for the period.

- Practical Example: If the market value of the plan assets increases significantly due to favorable investment returns, this gain would be recognized in OCI, affecting the equity section of the balance sheet but not the profit or loss for the period.

- Disclosure Requirements:

IAS 19 imposes extensive disclosure requirements to provide users of financial statements with relevant information about the nature of the employee benefits, the associated risks, and the financial impact on the entity.

- Example: Companies must disclose the amount recognized in the financial statements for each type of employee benefit, the assumptions used in actuarial valuations, and the sensitivity of the defined benefit obligation to changes in key assumptions.

Relationship Between Post-Employment Benefits and Contribution Plans

The relationship between post-employment benefits and contribution plans is primarily defined by their categorization under IAS 19. While both fall under the broader umbrella of employee benefits, they are accounted for differently:

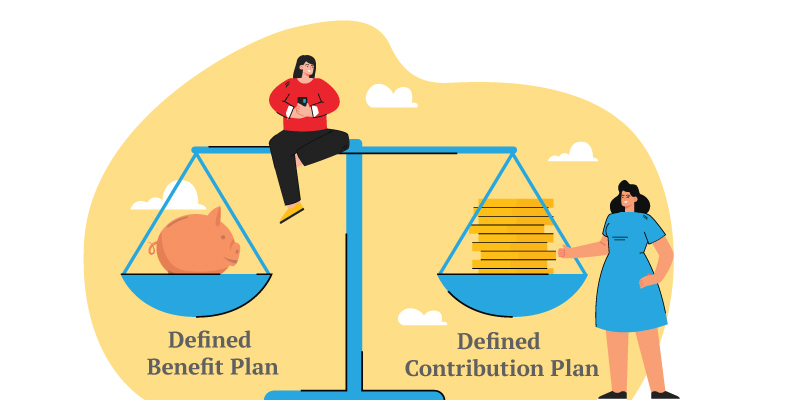

- Defined Contribution Plans: These plans are simpler to administer and account for, as the employer’s obligation is limited to the contributions made. The risk of investment performance and longevity falls on the employee.

- Defined Benefit Plans: These plans are more complex and require careful actuarial calculations to estimate future obligations. The employer bears the investment risk and is responsible for ensuring that sufficient funds are available to meet the promised benefits.

Key Insights on Defined Benefit Plans vs. Defined Contribution Plans

- Nature of Obligations:

- Defined Contribution Plans: In these plans, the employer’s obligation is limited to making fixed contributions to a fund. The benefits received by the employee depend on the contributions made and the investment performance of the fund. The employer does not bear the investment or actuarial risks; these risks are transferred to the employee or the fund.

- Defined Benefit Plans: Here, the employer guarantees a specific retirement benefit based on a formula that typically considers factors such as salary history, years of service, and age. The employer retains the investment and actuarial risks. This means that if the fund does not perform well, or if actuarial assumptions are not met, the employer must make up the shortfall.

- Example: Company A has a defined contribution plan where it contributes 10% of an employee’s salary to a retirement fund. If the employee earns $50,000, the company contributes $5,000 annually. Conversely, Company B offers a defined benefit plan that promises a pension of 2% of the employee’s final salary for each year of service. If the employee works for 30 years and their final salary is $70,000, they would receive a pension of $42,000 annually.

- Defined Contribution Plans: In these plans, the employer’s obligation is limited to making fixed contributions to a fund. The benefits received by the employee depend on the contributions made and the investment performance of the fund. The employer does not bear the investment or actuarial risks; these risks are transferred to the employee or the fund.

- Accounting Treatment:

- Defined Contribution Plans: The accounting for defined contribution plans is straightforward. The employer recognizes an expense for the contributions made during the period, and there are no further obligations beyond these contributions.

- Defined Benefit Plans: The accounting is more complex. Employers must calculate the present value of the defined benefit obligation using actuarial assumptions, which include discount rates, salary growth, and mortality rates. The projected unit credit method is commonly used to measure the obligation, leading to a more nuanced recognition of expenses and liabilities.

- Practical Example: If Company C has a defined benefit plan with an obligation of $1 million based on actuarial calculations, it must recognize this liability on its balance sheet. The company will also need to account for service costs and interest costs related to the obligation, which can fluctuate based on changes in actuarial assumptions.

- Defined Contribution Plans: The accounting for defined contribution plans is straightforward. The employer recognizes an expense for the contributions made during the period, and there are no further obligations beyond these contributions.

- Impact on Financial Statements:

- Defined Contribution Plans: The impact on financial statements is generally limited to the expense recognized in the income statement and the liability for contributions payable at the reporting date. This simplicity often leads to less volatility in reported earnings.

- Defined Benefit Plans: These plans can introduce significant volatility into financial statements. Changes in actuarial assumptions or investment returns can lead to substantial fluctuations in the defined benefit obligation and the associated expense recognized in profit or loss. Actuarial gains and losses are typically recognized in other comprehensive income, affecting equity but not profit or loss.

- Defined Contribution Plans: The impact on financial statements is generally limited to the expense recognized in the income statement and the liability for contributions payable at the reporting date. This simplicity often leads to less volatility in reported earnings.

- Disclosure Requirements:

- IAS 19 requires extensive disclosures for defined benefit plans, including the nature of the plans, the risks associated with them, and the assumptions used in the actuarial valuations. In contrast, defined contribution plans require less detailed disclosures, primarily focusing on the contributions made during the reporting period.

- Example: For a defined benefit plan, Company D must disclose the reconciliation of the opening and closing balances of the defined benefit obligation, the fair value of plan assets, and the amounts recognized in profit or loss and other comprehensive income. For a defined contribution plan, the disclosure would simply include the total contributions made during the year.

- IAS 19 requires extensive disclosures for defined benefit plans, including the nature of the plans, the risks associated with them, and the assumptions used in the actuarial valuations. In contrast, defined contribution plans require less detailed disclosures, primarily focusing on the contributions made during the reporting period.

Relationship and Categorization

The categorization of post-employment benefits into defined contribution and defined benefit plans under IAS 19 is critical for understanding the financial implications for employers and employees. While both types of plans serve the same purpose—providing retirement benefits—they operate under fundamentally different principles and risk-sharing arrangements.

- Hybrid Plans: Some plans may exhibit characteristics of both defined contribution and defined benefit plans, known as hybrid plans. These require careful analysis to determine the appropriate accounting treatment under IAS 19. For example, a plan that guarantees a minimum return on contributions but also allows for additional benefits based on investment performance may need to be classified based on the predominant features.

How does IAS 19 address the allocation of future salary increases in defined benefit plans

IAS 19 Employee Benefits provides guidance on how to allocate the benefits in a defined benefit plan to periods of service. The key points regarding the treatment of future salary increases are:

- IAS 19 requires entities to attribute the benefit in defined benefit plans to periods of service in accordance with the benefit formula, unless the benefit formula would result in a materially higher level of benefit allocated to future years.

- If the benefit formula would allocate a materially higher level of benefit to future years, the entity must allocate the benefit on a straight-line basis over the service period.

- The IFRIC (IFRS Interpretations Committee) previously considered whether entities should take into account expected increases in salary when determining if a benefit formula expressed in terms of current salary allocates a materially higher level of benefit to later years. However, this issue was suspended pending the Board’s deliberations on post-employment benefits.

- The 2010 Exposure Draft for the revised IAS 19 proposed that expected future salary increases should be included in the attribution of benefits to periods of service.

- IAS 19 (2011) requires the defined benefit obligation to be measured using the projected unit credit method, which incorporates future salary increases into the calculation. The measurement is updated each period to reflect changes in actuarial assumptions, including salary growth.

In summary, while IAS 19 does not explicitly state whether expected future salary increases should be considered when determining the attribution of benefits, the requirement to use the projected unit credit method effectively incorporates the impact of salary growth into the defined benefit obligation. The standard focuses on ensuring that the allocation of benefits to periods of service is not materially front-loaded.